With the increasing adoption of electric vehicles (EVs) worldwide, businesses, property owners, and fleet operators are looking into EV charging infrastructure as a lucrative investment. However, understanding the return on investment (ROI) for EV chargers requires a thorough analysis of multiple factors, including installation costs, pricing strategies, utilization rates, and long-term financial benefits.

This article explores how to calculate the ROI of EV charging stations, factors that impact profitability, and strategies to maximize returns.

The ROI of an EV charging station depends on several elements, from strategic placement to pricing structures. Below are key factors that influence profitability.

The placement of EV chargers plays a critical role in their usage and revenue generation. Strategic locations near highways, urban centers, or commercial hubs attract more users, increasing utilization rates.

For fleet operators, minimizing vehicle downtime is essential. Installing chargers close to major routes, depots, and logistics hubs prevents unnecessary detours, ensuring efficient fleet operations. Moreover, for heavy-duty vehicles such as buses and trucks, charging stations should be designed with robust infrastructure and ample space for seamless maneuvering and simultaneous charging.

Pricing directly impacts the revenue generated from an EV charging station. Several models can be employed:

- Pay-per-use pricing: Customers are charged based on kWh consumption or charging duration.

- Flat-fee charging: A fixed fee is set per session, regardless of energy consumption.

- Subscription models: Regular EV users pay a monthly or annual fee for discounted charging rates.

- Dynamic pricing: Rates fluctuate based on demand, location, and peak/off-peak hours.

Selecting the right pricing structure depends on user demographics and competition in the region.

High utilization rates lead to faster ROI. A charging station located in a high-traffic area with frequent users will recover investment costs quicker than one with sporadic usage. Fleet charging stations typically have higher utilization rates compared to public stations, making them a more predictable investment.

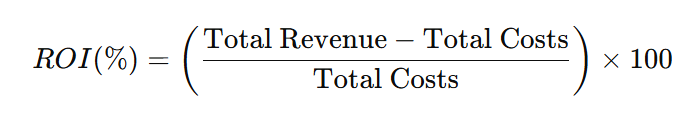

To determine profitability, the ROI of an EV charging station can be calculated using the following formula:

ROI = [(Total Revenue - Total Cost) / Total Cost] x 100

Where:

- Total Revenue includes income from charging fees, government incentives, and additional services.

- Total Costs cover installation, maintenance, energy consumption, and operational expenses.

The payback period refers to the time it takes for an investment to break even. It is calculated as:

Payback Period= Total Investment / Annual Profit

A shorter payback period (typically between 3-5 years) indicates a profitable investment.

Governments worldwide offer incentives to encourage EV infrastructure development. These may include:

- Federal and state tax credits

- Grants and funding programs

- Rebates on installation and equipment costs

Leveraging these incentives significantly reduces upfront investment costs, leading to a faster ROI.

Costs vary depending on charger type and infrastructure requirements:

- Level 1 chargers: Low installation cost but slow charging speeds.

- Level 2 chargers: Moderate cost, suitable for public and commercial use.

- DC fast chargers: Higher installation costs but faster charging, ideal for high-traffic areas.

Other expenses include site preparation, electrical upgrades, and maintenance. Choosing energy-efficient and durable chargers minimizes long-term operational costs.

To maximize ROI, station owners can explore multiple revenue streams:

- Energy sales: Direct earnings from charging fees.

- Advertising partnerships: Digital display screens on chargers generate ad revenue.

- Membership programs: Offering subscription-based services for frequent users.

To enhance profitability, investors and businesses can adopt the following strategies:

Higher usage translates to faster revenue generation. Strategies include:

- Placing stations in high-traffic areas

- Offering promotions to attract early adopters

- Partnering with businesses and fleets for consistent usage

Property owners and fleet operators can generate income by:

- Charging tenants, employees, or customers for energy consumption

- Implementing access fees for charger usage

- Offering premium fast-charging options at higher rates

Implementing dynamic pricing ensures optimal revenue generation. For example:

- Peak-hour charging rates can be higher due to demand.

- Off-peak discounts encourage usage during low-demand periods.

- Subscription plans provide steady revenue from frequent users.

One of the significant advantages of EV charging is reduced operating costs over time. EVs have a lower total cost of ownership (TCO) than internal combustion engine (ICE) vehicles, making them an economical choice for fleets.

- Fewer moving parts result in lower maintenance expenses.

- No need for oil changes, transmission repairs, or exhaust system maintenance.

- Electricity is generally cheaper than gasoline or diesel, leading to long-term fuel savings.

- Lower fuel and maintenance costs reduce operational expenses.

- Improved reliability leads to fewer breakdowns and service disruptions.

- Long-term cost predictability simplifies budgeting.

Financing options affect ROI. Owners can:

- Self-fund: Full ownership and control over pricing and revenue.

- Lease chargers: Lower upfront cost but shared revenue with providers.

- Partner with utilities or businesses: Shared investment models reduce individual costs.

Smart charging networks provide real-time data on usage patterns, energy consumption, and station efficiency. By leveraging insights, operators can:

- Identify peak usage times and adjust pricing accordingly.

- Monitor station health to reduce downtime.

- Optimize energy consumption to lower electricity costs.

Investing in EV charging stations presents a promising financial opportunity, but profitability depends on strategic planning. By selecting optimal locations, implementing effective pricing strategies, leveraging incentives, and utilizing data analytics, businesses can maximize their ROI. As EV adoption continues to rise, well-placed and efficiently managed charging stations will become an essential and profitable part of sustainable transportation infrastructure.